The Finance Leader's Guide to Being Acquired

As an executive at Invoice2go, I was tasked with leading the acquisition process to Bill.com for $625 million. Invoice2go had 100 employees with 225,000 SMB customers in 150 countries, employees in 4 countries operating at $35M ARR at the time of acquisition.

Prior to Invoice2go, I executed many M&A transactions from early stage startups to public companies, including selling companies to Adobe, Salesforce, carving a company out of Intuit, and operating as the buyer as well. Speaking from experience, here’s a high level overview of what to expect as you move towards this enormous company milestone. It’s a very rewarding yet tedious process.

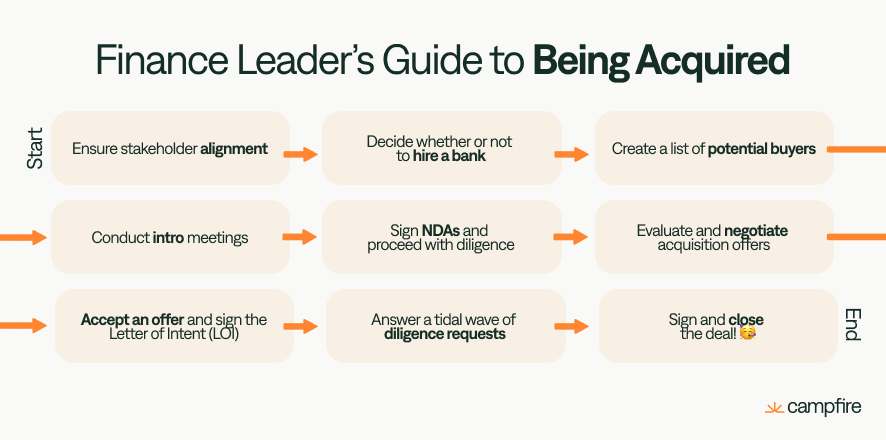

Ensure stakeholder alignment.

Deciding to sell your company is an enormous decision in itself. No matter the reason, all necessary stakeholders must be aware and aligned. This includes the management team, the board, and the finance/accounting teams. As a finance leader, it’s important to remember that you may not have a role after the acquisition, my advice is to protect yourself with double trigger vesting and/or an acquisition bonus. Thankfully I had a board that supported both incentive structures, but if this structure is not in place, I would approach your CEO and share that you want to align your financial incentives with the company. I was granted the opportunity to decide between becoming an executive at Bill.com or accepting the double trigger vesting - I chose to join!

Note that at this stage, the hope to sell, at a great price, and to a company of the ‘right-fit’, is only an idea. You may still be evaluating other options for the business, such as raising another round of funding, continuing to operate as a standalone company or going public. This is called a dual-track process, when an acquisition and a fundraise are explored concurrently.

Decide whether or not to hire a bank.

Hiring a bank is a major decision as you proceed towards a sale. While knowledgeable, banks come at a cost. Paid out with a percentage of your total transaction price, bank fees typically range between 1-3% for most middle-market transactions ($50M - $500M). However, fees may increase or decrease depending on the size of the deal, and often include a $25k to $100k retainer upon hire.

Because we felt our finance and leadership team at Invoice2go had enough collective M&A experience, we decided to proceed without a bank partner. My general guidance is the larger and/or complex the proposed transaction, the deeper the transaction experience required of the management team before proceeding without a buyer. A proxy will be to evaluate how overwhelmed or comfortable the management team, with the support of the board, felt during the most recent fundraise. For example, if the company recently raised a Series C, and the management team did not seem overwhelmed nor inexperienced in that process, then engaging in an M&A event without a banker might be the right approach. Irrespective of if you hire a banker or not - hiring a great M&A lawyer is paramount and can help fill in the gaps of not having a banker during negotiations and work streams such as the shareholder proceeds waterfall.

Create a list of potential buyers.

Having a strong buyer list is foundational to the success of a sale. Identify a list of potential fits based on known business strategy - where do your company strengths match another company’s weaknesses? You’ll typically want to tier your list to initially focus on the best potential buyers, and then have a second tier for lower quality prospective buyers that are reserved for broadening the outreach if required.

If you have a board, presenting this list for feedback will be necessary. Once aligned with the board, you have your final buyer list.

Conduct introduction meetings.

Similarly to finding a job, you’ll want to curate introductions to the right contacts across your buyer list. Generally, the objective is to receive introductions to the CEO, product team, or corporate development team. Using only warm connections (ie via founder or board members), is paramount to tightly guarding the information of a potential sale. The board will often have portfolio companies that have engaged with buyers on your list, and in our case one of our board members recently brokered an acquisition of one of their portfolio companies to one of our prospective buyers, providing a direct line of communication to the ideal executive and insights into how they operate during an M&A transaction.

Your goal with introduction meetings is to narrow down your list to a handful of ‘potential fit’ buyers. The first call is typically held with the CEO and/or Corporate Development Team and is used to better assess if your organizations are strategically aligned. You’re looking to understand if there is an opportunity to bring together businesses, and also gauge the potential buyer’s level of interest in doing so. Remember that these are mutual fit meetings similar to a first round job interview, and you are evaluating your counterpart as much as they are you.

Sign NDAs and proceed with diligence.

You can expect to establish ‘potential fit’ with only a handful of companies you’ve met, if any at all. Once strong interest has been established, you’ll move into diligence. Before any information is shared, it’s important to ensure NDA’s are in place to protect your company.

There are two main phases of diligence:

Phase 1: Data Room - this includes information on the company's basic financials and strategy. Information is generally presented in a company overview deck, and may include:

Product overview - likely from a sales deck and/or video product demo

Organizational overview - headcount by department and location

Financial overview - 3 year financial summary with more detail on revenue metrics such as SaaS metrics

Customer overview - ideal customer profile, customer breakdown by segment / geographic, and other vectors of reporting as applicable to your business

Phase 2: Sensitive information - this stage is reserved for serious buyers that continue to show strong interest in acquisition post-Data Room. It’s typically completed after an initial indication of interest (IOI). Information that may be shared in this stage includes:

More detailed historical and forecasted financial model

Detailed customer analysis such as cohorts by time period, and potentially a customer list, or list of larger customers, depending on how competitive the buyer is to your company.

Evaluate and negotiate acquisition offers.

After preliminary diligence, you’ll either want to set, 1) a deadline for serious buyers to make an acquisition offer, 2) let the market naturally unfold and create a bid deadline once an initial offer is received. It’s similar to selling a home - you can run a formal process or informal process, and this is largely set by how aggressive and serious you are about selling.

While evaluating offers, here are a few things to consider:

The purchase price and mix of consideration (stock vs. cash)

Key terms - earn out, shareholder lock-up periods, executive terms such as lock-up or re-vesting of shares

Deal termination - What level of materiality is required for the deal to be terminated - i.e., if fraud is uncovered during diligence vs. if the customer base is deemed to be less desirable once a deeper evaluation is performed. Even capitalizing the word Material vs. material is a negotiation in itself - capitalized M is well defined in the court system and carries legal precedent.

Once the executive team and board have aligned on the preferred acquisition offer, negotiations begin. The final offer is presented to the board for sign-off before accepting with a Letter of Intent (LOI). At Invoice2go, we received a range on the offer that indicated a general price that was to be finalized once more diligence was performed.

Accept an offer and sign the Letter of Intent (LOI).

Congratulations! You’ve accepted an offer and signed the LOI. The LOI is a preliminary, non-binding document that outlines the key terms and conditions of the sale. Because of these terms, there is a significant amount of diligence work between sign and close that can lead to deal determination.

Answer a tidal wave of diligence requests.

Depending on the size of the sale, buyers may also hire a significant amount of help to conduct due diligence. From my own experience with Bill.com, this included:

Multiple legal teams to evaluate various specialty areas, like Australian tax, global transfer pricing, employment law, and the M&A legal team

Industry experts that deeply understood our industry (payment processing and accounts receivable software)

Financial consultants that reviewed our financials to assess the quality of our earnings (QoE report)

Expect to receive a significant amount (500+ in our case) of diligence requests from your buyer. In order to tackle these, put together a small team of 5-10 people that are “under the tent”, meaning that they are aware of the acquisition when it is still confidential to the rest of the org.

The large portion of our diligence requests involved Invoice2Go’s financials. Despite having a strong finance/accounting team, we were still operating in QuickBooks, which meant our revenue accounting, SaaS reporting, multi-entity consolidations, and prepaids were all in spreadsheets. Having the wrong software made for a very painful diligence process - as we did not have most answers readily available, they were instead produced manually in spreadsheets on long nights and through weekends. In fact, this is one of the reasons that I founded Campfire! It’s the platform I wish we had, with native in-product pivot tables, advanced filtering and custom reporting dimensions, helping teams move faster and make smarter decisions.

Diligence requests can also be wide ranging and will uncover unexpected ‘risks’ that your management team was not previously aware of. For us, this included a 3-year old email from a YouTuber suggesting our logo was too similar to theirs. While seemingly nothing, this was seen as a potential copyright infringement issue for our buyer's legal team.

It’s your buyer's responsibility to acknowledge and weigh out all potential risks associated with the acquisition. The process will inevitably bring up dirt on your company, but with honesty and transparency, you’ll find a way through.

Sign and close the deal! 🥳

Once due diligence is complete, and the deal is ready to close, there’s a very stressful 1-2 weeks of going through the closing checklist. All of the loose ends need to be tied off. A few examples include drafting a communications plan for employees, key customers/partners and the broader public, and a final board meeting at the company to approve of the transaction. Our final board meeting was celebratory in nature, but also the realization that I work at a different company now and my role will be very different after the acquisition - more on that in a later post.

What’d we miss? Shoot us a note at [email protected] with any feedback.